Tech & IT

Tech & IT

Business

Business

Coding & Developer

Coding & Developer

Finance & Accounting

Finance & Accounting

Academics

Academics

Office Applications

Office Applications

Art & Design

Art & Design

Marketing

Marketing

Health & Wellness

Health & Wellness

Sounds & Music

Sounds & Music

Lifestyle

Lifestyle

Photography

Photography

More Learnfly

Business Solution Become an InstructorStock trading is the buying and selling of company shares on stock exchanges. Traders aim to profit from price fluctuations by analyzing market trends, company performance, and economic indicators. It requires strategic decision-making and risk management in pursuit of financial gains.

By : Kevin W. Chiu

Cracking The VSA Code...

4.3 32

1:50:33 hrs 13 lectures All Level

By : Satyendra singh

Basic of Harmonic Pattern, Trading Process , its Advantage and Disadvantage , Crab, B...

4.8 1401

16 lectures Intermedite Level

By : Satyendra singh

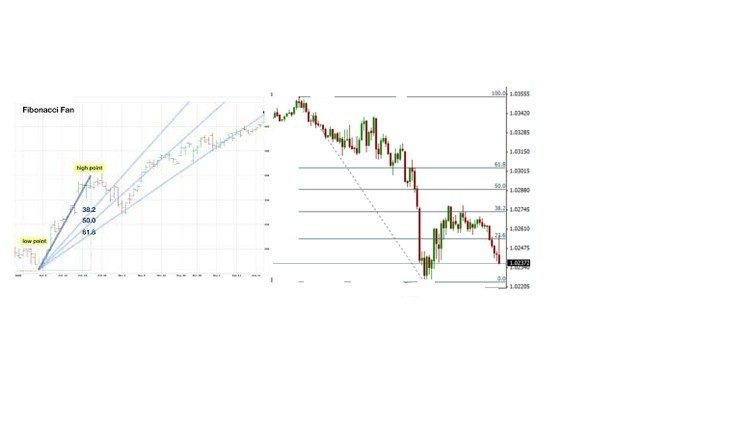

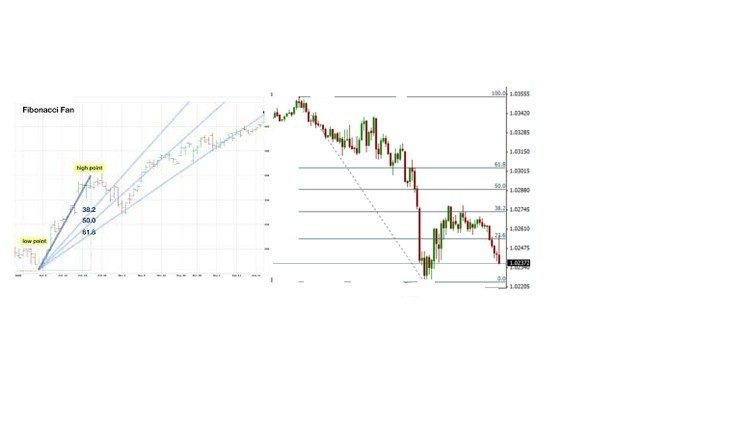

Fibonacci , Trendlines, Candlesticks , Fibonacci fan ,Fibonacci Arc , Technical indic...

4.8 1038

11 lectures Intermedite Level

By : Satyendra singh

Copper, soft commodiy ,crude oil trading, basics of commondity, trading strategies...

4.5 929

3:26:32 hrs 10 lectures Intermedite Level

By : Satyendra singh

Gold basics, silver basics , trading strategies with gold silver, basics of commomdit...

4.5 931

4:6:36 hrs 10 lectures Intermedite Level

By : Satyendra singh

Support resistance, Elliott Wave , Pivot points , Fibonncai, VIX, option chain, Stock...

4.5 1018

4:20:27 hrs 15 lectures Intermedite Level

By : Satyendra singh

Trading in crude oil ,Gold , silver,copper & natural gas with technical analysis con...

4.5 934

6:39:52 hrs 19 lectures Expert Level

By : Satyendra singh

Candlestick patterns, trendline, Support resistance, stock selection criteria, good ...

4.5 972

32 lectures Intermedite Level

By : Satyendra singh

28 Option Trading Strategies ,Options Basic and Greek Option , Time Decay , Risk G...

4.4 849

48 lectures Expert Level

By : Satyendra singh

Trading Strategies, Candlesticks, Patterns,Technical Indicators,Stock Selection,Entry...

4 1000

5:59:7 hrs 31 lectures Intermedite Level

Learn more topics in various categories at one place. Explore unlimited courses in other categories and up-skill yourself today.

Jazeb Akram

Jazeb Akram 4.2 771161 Beginner Level

John Hedengren

John Hedengren 4.1 569065 All Level

Ranjan Pandey

Ranjan Pandey 4.1 346732 All Level

Muhammad Ahsan Pervaiz

Muhammad Ahsan Pervaiz 4.2 101339 All Level

Pieter Vliegenthart

Pieter Vliegenthart 4.6 100919 All Level

Jerome P.

Jerome P. 4.8 100882 All Level

Senol Atac

Senol Atac 4.9 100095 All Level

Vikas Munjal

Vikas Munjal 4.8 100066 Beginner Level

Avinash A

Avinash A 4.8 100017 All Level

Kevin W. Chiu

Kevin W. Chiu13 Lectures Intermedite

Debasruta Chowdhury

Debasruta Chowdhury 6 Lectures Intermedite

Prabh Kirpa Classes

Prabh Kirpa Classes6 Lectures Intermedite

.jpg)

TechLatest .Net

TechLatest .Net8 Lectures Intermedite

Satyendra singh

Satyendra singh16 Lectures Intermedite

Satyendra singh

Satyendra singh11 Lectures Intermedite

Satyendra singh

Satyendra singh10 Lectures Intermedite

Satyendra singh

Satyendra singh10 Lectures Intermedite

Satyendra singh

Satyendra singh15 Lectures Intermedite

Satyendra singh

Satyendra singh10 Lectures Intermedite

Satyendra singh

Satyendra singh19 Lectures Intermedite

Satyendra singh

Satyendra singh32 Lectures Intermedite

Satyendra singh

Satyendra singh12 Lectures Intermedite

Satyendra singh

Satyendra singh18 Lectures Intermedite

Satyendra singh

Satyendra singh48 Lectures Intermedite

Satyendra singh

Satyendra singh31 Lectures Intermedite

Satyendra singh

Satyendra singh18 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)19 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)33 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)37 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)31 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)34 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)37 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)45 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)33 Lectures Intermedite

Nrupen Masram

Nrupen Masram24 Lectures Intermedite

Nrupen Masram

Nrupen Masram8 Lectures Intermedite

Nrupen Masram

Nrupen Masram15 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)32 Lectures Intermedite

Nrupen Masram

Nrupen Masram12 Lectures Intermedite

Satyendra singh

Satyendra singh27 Lectures Intermedite

Satyendra singh

Satyendra singh15 Lectures Intermedite

Satyendra singh

Satyendra singh23 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)43 Lectures Intermedite

Dinesh Kumar (NISM Certified)

Dinesh Kumar (NISM Certified)40 Lectures Intermedite

Amal mouna bouhlal

Amal mouna bouhlal27 Lectures Intermedite

Amir Rimer

Amir Rimer76 Lectures Intermedite

David Oisamoje

David Oisamoje13 Lectures Intermedite

.jpg)

David Oisamoje

David Oisamoje13 Lectures Intermedite

Daksh Murkute

Daksh Murkute12 Lectures Intermedite

Daksh Murkute

Daksh Murkute25 Lectures Intermedite

Daksh Murkute

Daksh Murkute9 Lectures Intermedite

Daksh Murkute

Daksh Murkute13 Lectures Intermedite

Chandramouli Jayendran

Chandramouli Jayendran115 Lectures Intermedite

Tawanda Irvine Makoni

Tawanda Irvine Makoni15 Lectures Intermedite

Anurag Singal

Anurag Singal27 Lectures Intermedite

Stock trading involves buying and selling shares of publicly traded companies on stock exchanges. Traders aim to profit from price fluctuations in stocks by executing trades based on market analysis, trends, and other factors.

Stock trading is popular for its potential to generate returns and provide liquidity to investors. It offers opportunities for capital appreciation, dividends, and portfolio diversification. The stock market also plays a key role in capital allocation for businesses.

Main types include day trading (buying and selling within the same trading day), swing trading (holding stocks for a few days to weeks), and long-term investing (buying and holding for an extended period). Each approach has its own risk and reward profile.

Technical analysis involves studying historical price charts and trading volumes to predict future price movements, while fundamental analysis evaluates a company's financial health, management, and industry trends. Traders often use a combination of both methods to make informed decisions.

Risks include market volatility, economic uncertainties, and company-specific factors affecting stock prices. Traders may also face risks related to leverage, liquidity, and psychological factors. Risk management strategies are essential to mitigate potential losses.